Anna Hazare's fast seeking the acceptance of the Jan Lokpal Bill, and the widespread mass protests in urban India that followed his arrest from home, have shaken the government. Political parties have woken up to the depth of feeling against corruption. Two factors have come together — the fight for the Jan Lokpal Bill and the violation of the citizen's civil right to protest.

The snowballing protests are seen to be against corruption. Obviously, the public are fed up with the day-to-day harassment they face. To put this in perspective, it is important to understand the benefits to society of tackling the huge black economy in India. Some people argue that the black economy also generates jobs and production. For instance, they argue that a lot of goods are bought in the market using black incomes, and that leads to increase in production and employment. They argue that the black economy generates informal sector employment and helps the poor. Some go to the extent of arguing that India escaped the worst effects of the global recession in 2008, and the economy only slowed down, because a large amount of black money was floating around — which generated additional demand.

Gmail is email that's intuitive, efficient, and useful. 15 GB of storage, less spam, and mobile access.

Some justify bribes as “speed money” that enables work to be done faster. There is some truth in all this. Yet, it can be shown that the ill-effects of the black economy far outweigh its beneficial effects. Think of bribe as “speed money.” In order to extract a bribe, the bureaucracy first slows down work and harasses the public. If work was automatically done, why would anyone pay bribes? Thus, the system has to be made inefficient so that those who can afford to pay can get their work done quickly but the rest continue to suffer. The administration becomes rundown since rather than devising ways to work efficiently, it is busy thinking of ways to make money by setting up roadblocks to efficient functioning.

This has spawned a culture of ‘middlemen' and personal approach to officers. Things hardly happen in the routine manner. The corrupt need the middleman to insulate themselves from direct public contact lest someone reports them. The bribe-giver also, not knowing how much to bribe and how to contact the administrator in charge, finds it a convenient arrangement. Much of the black economy in India is like “digging holes and filling them.” That is, one digs a hole during the day and then another fills it up at night; the next day there is zero output but two salaries are paid. This is “activity without productivity.” An example is of poorly made roads that get washed away or become pot-holed with every rain and need repeated repairs. Thus, instead of new roads coming up, much of the budget allocation is spent on maintenance.

Teachers may not teach properly in class so that students have to go for tuitions. Not only families have to pay extra but the students find learning to be insipid and lose interest.

This affects their creativity and future. Consider how millions of litigants, their families/friends, and lawyers arrive daily in the courts. In most instances, the hearing in a particular case lasts just a few minutes. The next date, weeks or months away, is announced, and they go back home. Not only is justice delayed inordinately, but time is lost and expenses are incurred on lawyers' fees, travel, and so on.

Cases that could be resolved in a few months go on for years, multiplying costs. The expense of delayed justice is both direct and indirect. Delay is often a result of the impact of the black economy.

Honest people who lose hope start resorting to other means, which dents the notion of social justice and weakens society. This cost cannot be calculated in monetary terms but it is significant. Because of the growing black economy, policies fail both at the macro-level and the micro-level. Planning or monetary policy or fiscal policies do not achieve the desired results because of the existence of a substantial black economy. Targets for education, health, drinking water and so on are not achieved because “expenditures do not mean outcomes.” The economy does not lack resources but faces resource shortage. Much investment goes into wasteful and unproductive channels, like holding gold or real estate abroad.

The flight of capital lowers the employment potential and the level of output in the economy. Capital sent abroad does not generate output in India but does so where it goes. A country that is considered capital-short has been exporting capital. A nation that gives concessions to multinational corporations to bring in capital loses more capital than it gets, and that too at a high cost, from foreign institutional investments or foreign direct investment. India's policies are open to the dictates of international capital because the country's businessmen and politicians have taken capital out in large doses since Independence. The costs are huge.

The direct and indirect costs are of policy failures, unproductive investments, slower development, higher inequity, environmental destruction and a lower rate of growth of the economy than would have been possible. India could have been growing faster, by about 5 per cent, since the 1970s if it did not have the black economy. Consequently, India could have been a $8-trillion economy, the second largest in the world. Per capita income could have been seven times larger; India would then have been a middle-income country and not one of the poorest.

That has been a huge cost. The black economy also leads to “the usual becoming the unusual and the unusual the usual.” That which should happen does not, and that which should not keeps happening. We should be getting 220 volts electricity but mostly get 170 volts or 270 volts. Equipment burns out, so all expensive gadgets need voltage stabilizers. This results in higher capital costs; maintenance costs rise.

Water in taps should be potable, but it is of uneven quality because the pipes are not properly laid and sewage seeps in. Thus, people carry water bottles, use water-purifiers and boil water at great extra cost. Even then, people fall ill. Some 70 per cent of all disease in India is related to water, so we spend extra on hospitalisation and treatment. Then there is the associated loss of productivity; the poor are particularly the victims. Hospitalisation can be traumatic because of the large-scale callousness there.

Public hospitals are crowded and the doctors are overworked. Due to unhygienic conditions, patients can get secondary infection or attendants can fall sick. In private hospitals the patient is not sure whether unnecessary tests are being done and whether visits by consultants coming to see them are needed at all. Even after all this, cure is not assured: the drugs may be spurious, the intravenous fluid contaminated, and so on. The poor suffer from the presence of a large number of quacks in the market who give injections or steroids or an overdose of antibiotics. It is by the sheer strength of the human constitution that in spite of these adversities, many people get cured. The result of all this is that costs everywhere are higher than they need to be — raising the rate of inflation.

If capital is over-invoiced by businesses to make money, the cost of setting up industry is higher. If poor quality grain is sold in the public distribution system, the price is higher. If children need tuitions because of poor teaching, the family's cost is higher, and so on. At the social level, the cost is a loss of faith in society and its functioning. Hence many now seek individual solutions and discount societal processes.

At the political level there is fragmentation, with States demanding their own packages because the belief that the nation as a whole can deliver has been dented. The demand for smaller States is a corollary because the bigger States neglect the less vocal regions. Each caste, community and region now wants to have its own party to represent its narrow interest, leading to the proliferation of smaller parties. Can the cost of this fragmentation and loss of national spirit be calculated? New movements for a strong Lokpal, the right to education, food and information, are likely to recreate a common national ethos that is so necessary, and which may generate the political will to tackle the hugely expensive black economy. The fight for one is the fight for the other also. (The author is with the Centre for Economic Studies and Planning, School of Social Sciences, Jawaharlal Nehru University, New Delhi.

This article is based on his forthcoming book, Indian Economy since Independence: Tracing the Dynamics of Colonial Disruption in Society. E-mail: arunkumar1000@hotmail.com).

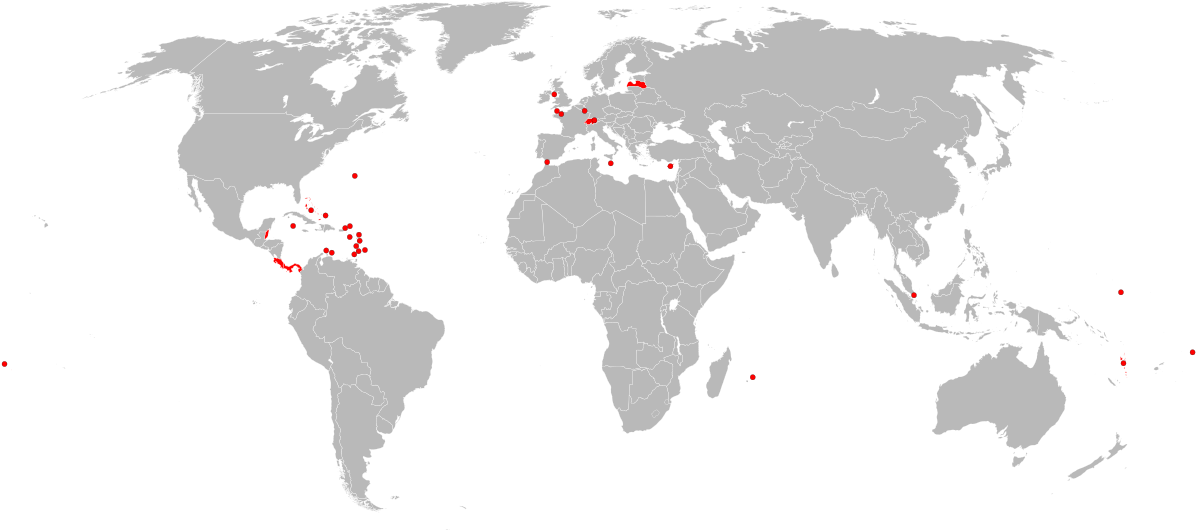

Map of, using the 2007 proposed ', US Congress, list of tax havens In India, black money refers to funds earned on the, on which income and other taxes have not been paid. The total amount of black money deposited in foreign banks by Indians is unknown. Some reports claim a total of US$1.06 trillion is held illegally in Switzerland. Other reports, including those reported by the and the, claim these reports are false and fabricated, and the total amount held in all by citizens of India is about US$2 billion.

In February 2012, the director of India's said that Indians have US$500 billion of illegal funds in foreign, more than any other country. In March 2012, the government of India clarified in its parliament that the CBI director's statement on $500 billion of illegal money was an estimate based on a statement made to India's Supreme Court in July 2011. In a televised address on 8 November 2016 by Indian Prime Minister, it was announced that of ₹500 and ₹1000 would cease to be from midnight. At some places were closed on 9 and 10 November.

Government organisations have brought out new notes. The Govt of India had accepted the proposal of in bringing out ₹2000 and a new version of the ₹500. The old notes are being removed from circulation. Source of black money Some Indian corporations practice, by under-invoicing their and over-invoicing their from such as Singapore, UAE, and Hong Kong. Thus the promoters of the public limited companies who hold rarely more than 10% of share capital, earn black money abroad at the cost of majority share holders and tax income to the Indian government.

Politicians, political parties and corrupt higher officials of government and its institutions take bribes from foreign companies and park or invest the money abroad in tax havens for transferring to India when needed. Many times locally earned bribes, funds, and collections are also routed abroad through channels for evading from Indian tax authorities and consequent legal implications. In the, a foreign multinational company also evaded tax payments in India by making transactions with registered in tax haven countries Round-tripping of black money The unlawfully acquired money kept abroad is routed back to India by the processes.

Round tripping involves getting the money out of one country, sending it to a place like Mauritius and then, dressed up to look like foreign capital, sending it back home to earn tax-favoured profits. (FDI) is one of the legal channels to invest in Indian stock and financial markets. As per data released by the (DIPP), two of the topmost sources of the cumulative inflows from April 2000 to March 2011 are Mauritius (41.80 per cent, US$54.227 billions) and Singapore (9.17 per cent, US$11.895 billions).

Mauritius and Singapore with their small economies cannot be the sources of such huge investments and it is apparent that the investments are routed through these jurisdictions for avoidance of taxes and for concealing the identities from the revenue authorities of the ultimate investors, many of whom could actually be Indian residents, who have invested in their own companies. Investment in the through participatory notes (PNs) or overseas derivative instruments (ODIs) is another way in which the black money generated by Indians is re-invested in India. The investor in PNs does not hold the Indian securities in her or his own name. These are legally held by the FIIs, but derive economic benefits from fluctuations in prices of the Indian securities, as also dividends and capital gains, through specifically designed contracts. Foreign funds received by charitable organisations, non-government organisations (NGOs) and other associations need not disclose the Indian beneficiary. Through official channel and smuggling is a major conduit to bring back the black money from abroad and convert in to local black money as the gold commands high demand among the rural investors particularly. Also fictitious high value round trip transactions via tax haven countries by diamonds and precious stones exporters and importers is a channel for to and fro transactions outside the country.

Also, fictitious software exports can be booked by software companies to bring black money in to India as tax exemptions are permitted to software companies. Unlike in earlier decades, the interest rates offered abroad in US currency is negligible and there is no capital appreciation if the money is parked abroad by the Indians. So, Indians are routing their foreign funds back to India as the capital appreciation in Indian is far more attractive. Black money in Swiss banks In early 2011, several reports Indian media alleged Swiss Bankers Association officials to have said that the largest depositors of illegal foreign money in Switzerland are Indian. These allegations were later denied by Swiss Bankers Association as well as the central bank of Switzerland that tracks total deposits held in Switzerland by Swiss and non-Swiss citizens, and by wealth managers as of non-Swiss citizens.

James Nason of Swiss Bankers Association in an interview about alleged black money from India, suggests 'The (black money) figures were rapidly picked up in the Indian media and in Indian opposition circles, and circulated as gospel truth. However, this story was a complete fabrication. The Swiss Bankers Association never said or published such a report. Anyone claiming to have such figures (for India) should be forced to identify their source and explain the methodology used to produce them.' In August 2010, the government revised the Double Taxation Avoidance Agreement to provide means for investigations of black money in Swiss banks. This revision, expected to become active by January 2012, will allow the government to make inquiries of Swiss banks in cases where they have specific information about possible black money being stored in Switzerland. In 2011, the Indian government received the names of 782 Indians who had accounts with.

As of December, 2011, the Finance Ministry has refused to reveal the names, for privacy reasons, though they did confirm that no current Members of Parliament are on the list. In response to demands from the (BJP) opposition party for the release of the information, the government announced on 15 December that, while it would not publish the names, it would publish a white paper about the HSBC information.

According to White Paper on Black Money in India report, published in May 2012, Swiss National Bank estimates that the total amount of deposits in all Swiss banks, at the end of 2010, by citizens of India were CHF 1.95 billion (INR 92.95 billion, US$2.1 billion). The Swiss Ministry of External Affairs has confirmed these figures upon request for information by the Indian Ministry of External Affairs. This amount is about 700 fold less than the alleged $1.4 trillion in some media reports. In February 2012, (CBI) director A P Singh speaking at the inauguration of first global programme on anti-corruption and asset recovery said: 'It is estimated that around 500 billion dollars of illegal money belonging to Indians is deposited in tax havens abroad. Largest depositors in Swiss Banks are also reported to be Indians'.

In a hint at scams involving ministers, Singh said: 'I am prompted to recall a famous verse from ancient Indian scriptures, which says – यथा राजा तथा प्रजा. In other words, if the King is immoral so would be his subjects' The CBI Director later clarified in India's parliament that the $500 billion of illegal money was an estimate based on a statement made to India's Supreme Court in July 2011. After formal inquiries and tallying data provided by banking officials outside India, the government of India claimed in May 2012 that the deposits of Indians in Swiss banks constitute only 0.13 per cent of the total bank deposits of citizens of all countries. Further, the share of Indians in the total bank deposits of citizens of all countries in Swiss banks has reduced from 0.29 per cent in 2006 to 0.13 per cent in 2010.

The through the released a White Paper on Black Money giving the Income Tax Department increased powers. 2015 HSBC leaks In February 2015, released the list of 1195 Indians account holders and their balances for the year 2006-07 in 's Geneva branch. The list was obtained by French newspaper and included the names of several prominent businessmen, diamond traders and politicians. The number of Indian HSBC clients is roughly double the 628 names that French authorities gave to the Indian Government in 2011.

Indian government said it will probe into this matter. The balance against the 1195 names stood at ₹25,420 crore (US$3.8 billion). The list which had names of dictators and international criminals, was simultaneously published by news organisations in 45 countries including The Guardian, UK; Haaretz, Israel; BBC, London. HSBC had helped its clients evade taxes and said in a statement that 'standards of due diligence were significantly lower than today.'

2016 Panama Papers leak. Main article: The 2016 Panama Papers scandal is the largest-ever leak of information on black money in history. First obtained the leaked information, revealing over 11 million documents. These documents pertain to 214,000 offshore entities and span almost 40 years.

The papers originated from, a Panama-based law firm with offices in more than 35 countries. The list of names exposed in the scandal includes 500 Indians who flouted rules and regulations, such as,,,, Garware family,, and others. Domestic black money Indian companies are reportedly misusing for money laundering. India has no centralized repository— like the registrar of companies for corporates—of information on public trusts. SIT on black money Noted jurist and former law minister along with many other well known citizens filed a (Civil) No. 176 of 2009 in the (SC) seeking the court's directions to help bring back stashed in abroad and initiate efforts to strengthen the governance framework to prevent further creation of. In January 2011, the SC asked why the names of those who have stashed money in the Liechtenstein Bank have not been disclosed.

The court argued that the government should be more forthcoming in releasing all available information on what it called a 'mind-boggling' amount of money that is believed to be held illegally in foreign banks. The on 4 July 2011, ordered the appointment of a Special Investigating Team (SIT) headed by former judge BP Jeevan Reddy to act as a watch dog and monitor investigations dealing with the black money. This body would report to the directly and no other agency will be involved in this. The two judge bench observed that the failure of the government to control the phenomenon of black money is an indication of weakness and softness of the government. The issue of unaccounted monies held by nationals, and other legal entities, in foreign banks, is of primordial importance to the welfare of the citizens. The quantum of such monies may be rough indicators of the weakness of the State, in terms of both crime prevention, and also of tax collection. Depending on the volume of such monies, and the number of incidents through which such monies are generated and secreted away, it may very well reveal the degree of 'softness of the State.'

— Justice B Sudershan Reddy and Justice S S Nijjar,, Source: The government subsequently challenged this order through No. The bench (consisting of Justice in place of Justice B Sudershan Reddy, since Justice Reddy retired) on 23 September 2011 pronounced a split verdict on whether government plea is maintainable. Justice said that the plea is maintainable while Justice Nijjar said it is not. Contemporary Nutrition Seventh Edition Gordon M Wardlaw Anne M Smith. Due to this split verdict, the matter will be referred to a third judge.

In April 2014, disclosed to the the names of 26 people who had accounts in banks in Liechtenstein, as revealed to India by German authorities. On 27 October 2014, Indian Government submitted name of three people in an affidavit to the Supreme Court who have black money account in foreign countries. But on the very next day, Supreme Court of India orders centre Government to reveal all the names of black money account holders which they had received from various countries like Germany. The honorable bench of the Supreme court also asked the Centre not to indulge in any kind of probe rather just pass the names to them and Supreme court will pass the order for further probe. But the facts were the other way round, as the clarification affidavit filed by the Finance Ministry on October 27 revealed.

The affidavit asserted that a complete list of cases where information had been obtained from the German and French governments, with the status of the action taken by the government was submitted by the Central Board of Direct Taxes on June 27. It added that the CBDT officials also met and briefed the SIT on the status of the cases, background of the information received, non-sharing of information by Swiss authorities, and constraints faced by the government and alternative methods of securing account details. On 12 May 2015, Ram Jethmalani attacked Modi Government for failing to bring back the Black money as was promised before Election. On 2 November 2015, whistleblower said he is willing to 'cooperate' with the Indian investigative agencies in probe but would need 'protection'. And furnished a letter written by Falciani on 21 August 2015, to Justice (retd) M B Shah, who is heading the SIT on black money.

Under the supervision of the SIT the I-T department has recovered just around Rs 3,500 crore from some of the account holders and expected to recover a total of 10000 crore till March 2015. Double taxation agreements Indian Government has repeatedly argued before the Court that it cannot divulge the names.

It has further argued that the privacy of individuals would be violated by the revelation of data. These arguments are only designed to stall the revelation of names of some favoured entities. BJP leader Dr. Said that DTA was not a valid reason for not revealing names of the accounts of Indians held in foreign banks. DTAA is about declared white incomes of entities so that tax may be levied in one or the other country and not in both. Black income is not revealed in either of the two countries so there is no question of double taxation. Further, this data would not be available to either of the two countries to be exchanged.

It is no wonder then that till date, no data has been supplied to India by any of the countries with which this treaty has been signed. In brief, DTAA is about white incomes and not black incomes, so it is disingenuous to say that in future no data would be given to us if names are given to courts. Criticism of government Different governments have tried to stall SIT. A bank has been revealed to have acted like a ' operator. Other MNC and private Indian banks are also suspected to have indulged in these activities The HSBC Black money whistleblower, who works with a team of lawyers and experts, told NDTV that there is '1000 times more information' available for investigators and there are a lot of business procedures to be unveiled to them. 'It's just up to (the Indian administration). They can contact us,' he said.

He said India was given only 2 MB of the 200 GB of data. 'If India asks tomorrow we will send a proposal tomorrow,' he added. On 2 November 2015, told in a press conference organised by and that, India has not used information on those illegally stashing away black money in foreign bank accounts, and still millions of crores were flowing out. Hasan Ali case was arrested by and the Income Tax Department on charges of stashing over 360 billion rupee in foreign banks. ED lawyers said Khan had financed international arms dealer on several occasions.

However, media sources claimed this case is becoming yet another perfect instance of how investigative agencies like Income Tax Department go soft on high-profile offenders. Ali's premises were raided by ED as far back as 2007.

According several news reports, the probe against him has proceeded at an extremely slow pace and seems to have hit a dead end. India Today claimed that it had verified a letter confirming the US$8 billion in black money was in a Swiss bank UBS account, and the government of India too has verified this with UBS. The Swiss bank UBS has denied Indian media reports alleging that it maintained a business relationship with or had any assets or accounts for Hasan Ali Khan accused in the US$8 billion black money case. Upon formal request by Indian and Swiss government authorities, the bank announced that the documentation supposedly corroborating such allegations were forged, and numerous media reports claiming US$8 billion in stashed black money were false. India Today, in a later article, wrote, 'Hasan Ali Khan stands accused of massive tax evasion and stashing money in secret bank accounts abroad. But the problem is that the law enforcement agencies have precious little evidence to back their claims. For one, UBS Zurich has already denied having any dealings with Khan.'

Estimates of Indian black money As Schneider estimates, using the dynamic multiple-indicators multiple-causes method and by currency demand method, that the size of India's black money economy is between 23 and 26%, compared to an Asia-wide average of 28 to 30%, to an Africa-wide average to 41 to 44%, and to a Latin America-wide average of 41 to 44% of respective gross domestic products. According to this study, the average size of the shadow economy (as a percent of 'official' GDP) in 96 developing countries is 38.7%, with India below average. Public protests and government's response. Further information: and In May 2012, the Government of India published a white paper on black money. It disclosed India's effort at addressing black money and guidelines to prevent black money in the future.

India has following institutions already preventing, finding and investigating underground economy and black money. Swami, popular as Baba is a Hindu swami and a yoga guru. He is a social activist and has staged protests against corruption in the country. He has been associated with the 2011 Indian anti-corruption movement and also started his Bharat Swabhiman first phase Yatra with the pledge of disease free India and simultaneously to eradicate corruption and bring back black money from the birthplace of Sri Krishna, Dwarika Gujarat on 2 September 2010. This yatra has been through 25 states of India like Rajasthan, Jammu and Kashmir, Himachal Pradesh, Haryana, Uttar Pradesh, Jharkhand, Chhattisgarh, Orrisa, Assam, West Bengal, Maharashtra, Meghalaya and ends at the city of Mahakal Ujjain. On 20 September Swami Ramdev had started second phase of his yatra from the fort of Jhansi. More than 1 lakh people of Jhansi city had taken pledge to fight against corruption.

On 30 January 2011, a written representation of people from over 600 districts was sent to the Prime Minister which contained demand of bringing back black money stashed abroad & putting an end to corruption, which was supported by all major social, spiritual groups and organizations of the nation. Himself sent the signed representation to the President of India through the District Magistrate of Bilaspur. Soon after on 27th Feb, 2011 he, organized a huge rally in Ramlila Maidan, Delhi which was attended by lakhs of people after which a written representation was handed over to the President to bring back black money, on the day which marks the birth anniversary of freedom fighter Shaheed Chandrasekhar Azad. Central Board of Direct Taxes: is a statutory authority functioning across India under the of 1963. The Member(Investigation) of the CBDT, exercises control over the. The Member is a high ranking IRS officer of the rank of Special Secretary to the Government of India.

The Member controls the: •. • • Directorate of Income Tax Intelligence and Criminal Investigation. The Director General of Income Tax (International Taxation) is in charge of taxation issues arising from cross-border transactions and transfer pricing. This organisation has been in operation for nearly 50 years, is primarily responsible for combating the menace of black money, has offices in more than 800 buildings spread over 510 cities and towns across India and has over 55,000 employees and even employees who are deputed from premier police organisations to aid the department.

Enforcement Directorate: was established in 1956. It administers the provisions of the of 1973 (FERA), later updated to of 1999 (FEMA). It is entrusted with the investigation and prosecution of money-laundering offences, confiscation of the proceeds of such crime, matters related to and international hawala transactions. This India-wide directorate, with focus on major financial centres in India, has 39 offices and 2000 employees. Financial Intelligence Unit: has been operating as a separate investigative entity since 2004. This government organisation for receiving, processing, analyzing and disseminating information relating to suspect financial transactions. It shares this information with other ministries, enforcement and financial investigative agencies of state and central government of India.

Every month, it routinely examines about 700,000 investigative reports and over 1,000 suspect financial transaction trails to help identify and stop black money and money laundering. Central Board of Excise and Customs and Directorate of Revenue Intelligence: is the apex intelligence organisation responsible for detecting cases of evasion of central excise and service tax.

The Directorate develops intelligence, especially in new areas of tax evasion through its intelligence network across the country and disseminates information across Indian government organisations by issuing Modus Operandi Circulars and Alert Circulars to apprise field formations of the latest trends in tax evasion. It routinely arranges for enforcement operations to research into the evasion of duty and taxes. The Directorate of Revenue Intelligence functions under the CBEC.

It is entrusted with the responsibility of collection of data and information and its analysis, collation, interpretation and dissemination on matters relating to violations of taxation and customs law. The organisation has thousands of employees and is divided into seven zones all over India. It maintains close liaison with the, Brussels, the Regional Intelligence Liaison Office at Tokyo,, and foreign customs administrations. Central Economic Intelligence Bureau: functions under India's Ministry of Finance. It is responsible for coordination, intelligence sharing, and investigations at national as well as regional levels amongst various law enforcement agencies to prevent financial crimes, generation and parking of black money and illegal transfers.

This organisation maintains constant interaction with its Customs Overseas Investigation Network (COIN) offices to share intelligence and information on suspected international financial transactions. The COIN offices gather evidence through diplomatic channels from the foreign custom offices and other foreign establishments to establish cases of mis-declaration to help identify and stop tax evasion and money laundering. In addition to the primary agencies listed above, India has 10 additional separate departments operating under the central government of India - such as National Investigation Agency and National Crimes Record Bureau - to help locate, investigate and prosecute black money cases.

Discovery and enforcement is also assisted by India's and state police. In addition to direct efforts, the Indian central government coordinates its efforts with state governments with dedicated departments to monitor and stop corporate frauds, bank frauds, frauds by non-banking financial companies, sales tax frauds and income tax-related frauds. MC Joshi committee on black money After a series of ongoing, the government appointed a high-level committee headed by MC Joshi (the then ) in June 2011 to study the generation and curbing of black money. The committee finalised its draft report on 30 January 2012.

Its key observation and recommendations were: • The two major national parties (an apparent reference to, BJP) claim to have incomes of merely ₹5 billion (US$74 million) and ₹2 billion (US$30 million). But this isn't 'even a fraction' of their expenses. These parties spend between ₹100 billion (US$1.5 billion) and ₹150 billion (US$2.2 billion) annually on election expenses alone. • Change maximum punishment under from the present 3, 5 and 7 years to 2, 7 and 10 years rigorous imprisonment and also changes in the years of punishment in the. • Taxation is a highly specialised subject.

Based on domain knowledge, set up all-India judicial service and a National Tax Tribunal. • Just as the USA under which global financial transactions above a threshold limit (by or with Americans) get reported to law enforcement agencies, India should insist on entities operating in India to report all global financial transactions above a threshold limit. • Consider introducing an scheme with reduced penalties and immunity from prosecution to the people who bring back black money from abroad. Tax Information Exchange Agreements To curb black money, India has signed TIEA with 13 countries -, Bahamas,, the, the, the,, Liberia, Monaco,, Argentina, and Bahrain - where money is believed to have been stashed away.

India and Switzerland, claims a report, have agreed to allow India to routinely obtain banking information about Indians in Switzerland from 1 April 2011. In June 2014, the Finance Minister Arun Jaitely on behalf of the Indian government requested the Swiss Government to hand over all the bank details and names of Indians having unaccounted money in Swiss banks. Proposals to prevent Indian black money History Even in colonial India, numerous committees and efforts were initiated to identify and stop underground economy and black money with the goal of increasing the tax collection by the British Crown government. For example, in 1936 Ayers Committee investigated black money from the Indian colony. It suggested major amendments to protect and encourage the honest taxpayer and effectively deal with fraudulent evasion.

Current Proposals In its white paper on black money, India has made the following proposals to tackle its underground economy and black money. Reducing disincentives against voluntary compliance Excessive tax rates increase black money and tax evasion. When tax rates approach 100 per cent, tax revenues approach zero, because higher is the incentive for tax evasion and greater the propensity to generate black money. The report finds that punitive taxes create an economic environment where economic agents are not left with any incentive to produce.

Another cause of black money, the report finds is the high transaction costs associated with compliance with the law. Opaque and complicated regulations are other major disincentive that hinders compliance and pushes people towards underground economy and creation of black money. Compliance burden includes excessive need for compliance time, as well as excessive resources to comply. Lower taxes and simpler compliance process reduces black money, suggests the white paper.

Banking transaction tax Arthakranti, Pune-based think-tank has outlined policy prescription that involves replacement of most direct and indirect levies with a banking transaction tax and de-monetisation of currency notes of Rs 500 and Rs 1,000 to help prevent Indian black money, ease inflation, improve employment generation and also lower corruption. Economic liberalisation The report suggests that non-tariff barriers to economic activity such as permits and licences, long delays in getting approvals from government agencies are an incentive to proceed with underground economy and hide black money.

When one can not obtain a licence to undertake a legitimate activity, the transaction costs approach infinity, and create insurmountable incentives for unreported and unaccounted activities that will inevitably generate black money. The successive waves of economic liberalisation in India since the 1990s have encouraged compliance and taxes collected by the government of India have dramatically increased over this period. The process of economic liberalisation must be relentlessly continued to further remove underground economy and black money, suggests the report. Reforms in vulnerable sectors of the economy Certain vulnerable sectors of Indian economy are more prone to underground economy and black money than others. These sectors need systematic reforms. As example, the report offers gold trading, which was one of the major sources of black money generation and even crime prior to the reforms induced in that sector.

While gold inflows into India have remained high after reforms, gold smuggling is no longer the menace as it used to be. Similar effective reforms of other vulnerable sectors like real estate, the report suggests can yield a significant dividend in the form of reducing generation of black money in the long term. The real estate sector in India constitutes about 11 per cent of its GDP. Investment in property is a common means of parking unaccounted money and a large number of transactions in real estate are not reported or are under-reported.

This is mainly on account of very high levels of property transaction taxes, commonly in the form of stamp duty. High transaction taxes in property are one of the biggest impediments to the development of an efficient property market. Real estate transactions also involve complicated compliance and high transactions costs in terms of search, advertising, commissions, registration, and contingent costs related to title disputes and litigation.

People of India find it easier to deal with real estate transactions and opaque paperwork by paying bribes and through cash payments and under-declaration of value. Unless the real estate transaction process and tax structure is simplified, the report suggests this source of black money will be difficult to prevent. Old and complicated laws such as the and need to be repealed, property value limits and high tax rates eliminated, while Property Title Certification system dramatically simplified. Other sectors of Indian economy needing reform, as identified by the report, include equity trading market, mining permits, bullion and non-profit organisations. Creating effective credible deterrence Effective and credible deterrence is necessary in combination with reforms, transparency, simple processes, elimination of bureaucracy and discretionary regulations. Credible deterrence needs to be cost effective, claims the report.

Such deterrence to black money can be achieved by information technology (integration of databases), integration of systems and compliance departments of the Indian government, direct tax administration, adding data mining capabilities, and improving prosecution processes. Supportive measures Along with deterrence, the report suggests public awareness initiatives must be launched. Public support for reforms and compliance are necessary for long term solution to black money. In addition, financial auditors of companies have to be made more accountable for distortions and lapses.

The report suggests Whistleblower laws must be strengthened to encourage reporting and tax recovery. Amnesty Amnesty programmes have been proposed to encourage voluntary disclosure by tax evaders. These voluntary schemes have been criticized on the grounds that they provide a premium on dishonesty and are unfair to honest taxpayers, as well as for their failure to achieve the objective of unearthing undisclosed money. The report suggests that such amnesty programmes can not be an effective and lasting solution, nor one that is routine.

International enforcement India has Double Tax Avoidance Agreements with 82 nations, including all popular tax haven countries. Of these, India has expanded agreements with 30 countries which requires mutual effort to collect taxes on behalf of each other, if a citizen attempts to hide black money in the other country. The report suggests that the Agreements be expanded to other countries as well to help with enforcement. Modified Currency Notes Government printing of such legal currency notes of highest denomination i.e.; ₹1,000 (US$15) and ₹500 (US$7.40) which remain in the market for only 2 years.

After a 2-year period is expired there should be a one-year grace period during which these currency notes should be submitted and accepted only in bank accounts. Following this grace period the currency notes will cease to be accepted as legal tender or destroyed under the instructions of The Reserve Bank of India. As a consequence turning most of the unaccountable money into accountable and taxable money. Corruption in education. Further information: Many institutions that are meant to provide education have been promoting corruption, and education has been a major contributor to domestic black money in India.

Single common entrance exams for various professional courses (medicine and allied, engineering and allied, business management and allied), releasing the audited financial statements of the trusts/not-for-profit organizations that own these educational institutions in the public domain (website, a common e-repository), stoppage of government funds from AICTE, DST etc. To such institutions, are some of the suggestions to reduce the generation of black money in education. Withdrawal of currency notes of higher denomination There has been suggestions to withdraw currency notes of higher denominations such as the 1000 rupee notes.

While this can lead to an increase in printing costs for RBI, the opinion is that that these costs should be weighed against the misuse of high-value notes. Ban on 1000 currency notes. Main article: Following recommendations from the OECD on curbing black money on 22–23 February 2014 and previous moves by the RBI, on the night of 8 November 2016 the Indian Government decided to ban old notes and change them with new 500 and 2000 rupee notes. Similar moves had been made earlier in pre-independence era in 1946 and also in 1978 by the first non-Congress government called.

ATMs all over India will remain closed for two days and banks for one day. Also, until 31 December people will only be allowed to withdraw Rs 2,500 maximum per day from ATMs, Rs 24,000 per week from banks.

Online bank transactions have been granted exemption from such limits. The issuing of the Rs. 2000 sought to throw hoarders of black money off by rendering the cash money they held in large denomination currency notes as useless. This meant they would need to get the notes exchanged at a bank or post office, which would be near impossible due to the exchange limits. Additionally, banks and authorities would question the large amounts of cash held by many hoarders, who now risked an official investigation being launched into their money situation. Economists and financial analysts believe that a large percentage of black money being held in cash in India would now be brought into the mainstream economy through the banks, which would bolster economic growth over the long term.

Furthermore, the move is also intended as a way to cut down on the funding of terrorism, by rendering useless the large currency denominations of black money or counterfeit currency being paid to. See also • • • • • • • • References. • Nanjappa, Vicky (31 March 2009).. Retrieved 23 May 2011.

Ministry of Finance, Government of India. SWISSINFO - A member of Swiss Broadcasting Corporation. The Times of India. Retrieved 29 July 2015.

Retrieved 29 July 2015. The Hindu - Business Line. 13 March 2012. 8 November 2016. Retrieved 8 November 2016. The Economic Times. 9 November 2016.

Retrieved 9 November 2016. Retrieved 29 July 2015. Retrieved 29 July 2015.

Retrieved 31 July 2015. Retrieved 31 July 2015. Retrieved 29 July 2015. 9 March 2011. Retrieved 9 May 2011. Swiss National Bank.

11 June 2012. The Times of India. 13 September 2009. • Ashok Dasgupta (8 April 2011).. Chennai, India. Retrieved 9 May 2011.

15 December 2011. Retrieved 7 January 2012. 14 February 2012. Retrieved 14 February 2012.

• Black Money, May 2012, MINISTRY OF FINANCE, DEPARTMENT OF REVENUE, CENTRAL BOARD OF DIRECT TAXES, NEW DELHI •. The Indian Express. 9 February 2015.

Retrieved 29 July 2015. The Indian Express.

9 February 2015. Retrieved 29 July 2015. • Jayant Sriram.. Retrieved 29 July 2015. • National Bureau.. Retrieved 29 July 2015. The Indian Express.

9 February 2015. Retrieved 29 July 2015.

• David Leigh.. The Guardian. Retrieved 29 July 2015. The Guardian.

Retrieved 29 July 2015. Retrieved 6 April 2016. Retrieved 6 April 2016. Retrieved 6 April 2016. Retrieved 6 April 2016. Retrieved 6 April 2016.

Supreme Court of India. Retrieved 15 September 2013. 19 January 2011.

Retrieved 9 May 2011. 19 January 2011. Retrieved 23 May 2011. Retrieved 2 May 2012. • Justice ALTAMAS KABIR; Justice SURINDER SINGH NIJJAR.. New Delhi: Supreme Court of India. Archived from on 29 July 2012.

Retrieved 29 July 2012. 23 September 2011. Retrieved 2 May 2012. Retrieved 29 April 2014. The Times of India. Retrieved 27 October 2014.

The Times of India. Retrieved 28 October 2014. • Vaidyanathan, Prof (2014-10-31).. Retrieved 2016-05-01. The New Indian Express.

Retrieved 2016-05-01. Retrieved 29 July 2015. The Times of India. Retrieved 29 July 2015.

Retrieved 29 July 2015. The Economic Times.

Retrieved 2016-10-08. The Indian Express. Retrieved 2016-10-08.

The Times of India. Retrieved 29 July 2015. The Indian Express. 8 November 2014. Retrieved 29 July 2015.

Retrieved 29 July 2015. • Arun Kumar.. Retrieved 29 July 2015.

The Times of India. Retrieved 29 July 2015. • Noopur Tiwari (20 November 2014).. Retrieved 29 July 2015.

The New Indian Express. Retrieved 2016-10-08. The Indian Express. Retrieved 2016-10-08. 3 February 2010. Archived from on 12 April 2011.

Retrieved 9 May 2011. 29 July 2011. Archived from on 30 July 2011. Retrieved 13 February 2012. 16 January 2012. Retrieved 13 February 2012.

30 November 2011. Retrieved 13 February 2012. 17 January 2012. Retrieved 13 February 2012. Retrieved 13 February 2012. Times of India.

30 November 2011. Retrieved 4 March 2012. • Bali Pavan (31 January 2011).. Deccan Chronicle. Retrieved 4 March 2012.

Retrieved 4 March 2012. Times of India.

3 March 2011. Retrieved 4 March 2012. The Indian Express.

Retrieved 4 March 2012. • R Vaidyanathan – Prof of finance and control, IIM Baglore (1 December 2011).. Retrieved 4 March 2012. 3 March 2011.

Deccan Herald. 16 February 2011.

• M Padmakshan (17 February 2011).. The Economic Times. 8 March 2011. • Friedrich Schneider (September 2006). Institute for the Study of Labor (IZA Bonn). • Owen Lippert, Michael Walker (December 1997). The Underground Economy: Global Evidence of Its Size and Impact.

• Frey and Schneider (2000). Retrieved 29 July 2015. Retrieved 29 July 2015.

Retrieved 29 July 2015. 2 August 2011. Retrieved 10 August 2012. 10 February 2012. Retrieved 9 February 2012. Chennai, India.

10 February 2011. Retrieved 29 July 2015. • Ayers, Chambers and Vachha (1936)..

• BS Reporter (24 January 2014).. Retrieved 29 July 2015. The Financial Express. Retrieved 29 July 2015.

Retrieved 4 September 2016. Missing or empty title= (help) •.

Retrieved 4 September 2016. Missing or empty title= (help) • • • • •. Retrieved 10 November 2016. Sfcedit Keygen Mac. Missing or empty title= (help). • Afghanistan • Armenia • Azerbaijan • Bahrain • Bangladesh • Bhutan • Brunei • Cambodia • • Cyprus • East Timor (Timor-Leste) • Egypt • Georgia • • Indonesia • Iran • Iraq • Israel • Japan • Jordan • Kazakhstan • • South Korea • Kuwait • Kyrgyzstan • Laos • Lebanon • Malaysia • Maldives • Mongolia • Myanmar • Nepal • Oman • Pakistan • Philippines • Qatar • Russia • Saudi Arabia • Singapore • Sri Lanka • Syria • Tajikistan • Thailand • Turkey • Turkmenistan • United Arab Emirates • Uzbekistan • Vietnam • Yemen.